- Career steps

- Career overview

- Important skills

- What do risk managers do?

- Job description

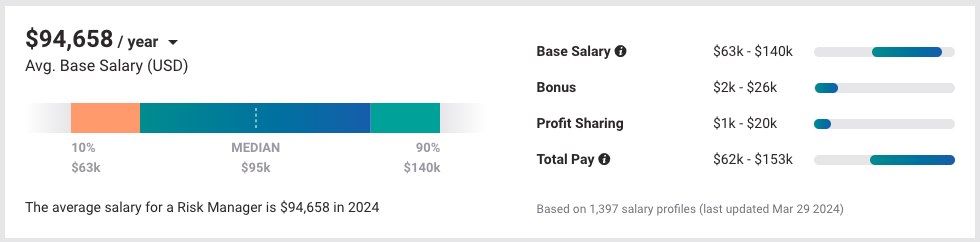

- Salary and outlook

Risk managers assess and quantify risk exposure for companies and organizations. The goal of risk managers is to insulate companies from security threats that could impact business functions and the bottom line.

Ad

cybersecurityguide.org is an advertising-supported site. Clicking in this box will show you programs related to your search from schools that compensate us. This compensation does not influence our school rankings, resource guides, or other information published on this site.

Featured Cybersecurity Training

| School Name | Program | More Info |

|---|---|---|

| Purdue Global | Online BS in Cybersecurity | website |

| UC Berkeley School of Information | Online Master’s in Cybersecurity | No GRE/GMAT Required | website |

| Southern New Hampshire University | Online BS in Cybersecurity or Online MS in Cybersecurity | website |

For companies that deal primarily with data and information, the corporate risk profile (threats to which a company is exposed) is closely linked to cybersecurity and data protection.

Risks are often related to safety and security for companies that deal mostly with physical goods and services.

Regardless of business type, there are four categories of risks that all companies must address. These, along with some of their subcategories, include:

- Market Risk

- Interest and currency exchange rates

- The fluctuating cost of materials

- Changing trade laws

- Compliance Regulations

- Credit Risk

- Customer defaults

- Vendor relationships

- Operational risk

- Fraud

- Employment and Business practices

- Continuity processes

- Employee safety and security

- Property and data protection

- Reputational Risk

- Brand perception

- Data breach or exposure

What is a risk manager?

A corporate risk manager is involved in many aspects of the business. The risk manager position should always be an executive role in the organization.

In some companies, risk management is elevated to the C Suite with the chief risk officer (CRO) role. Where the risk manager falls within the enterprise’s hierarchy is often an indication of the organization’s risk appetite or willingness to assume certain risks.

In simple terms, the role of a risk manager is to understand everything that could go wrong and what the consequences or impact on the business would be if it did go wrong. The “what could go wrong” scenarios are the threats. The “consequences or impact” of a threat is referred to as criticality.

In addition to understanding the criticality of the various threats faced by the organization, the risk manager must also understand the probability of a given threat happening to the company.

The basic formula applied by managers is Risk = Threat x Probability x Criticality. This formula can also be expressed as Risk = Threat x Vulnerability x Consequence.

To be effective, risk managers must monitor both external and internal influences that could affect their business.

Risk manager skills, and experience

While risk management careers span across all industries and organizational types, there are some skillsets and experiences that will help all risk managers be successful in their jobs. These include:

- Ability to objectively analyze data and information to form a big-picture view of risk

- Ability to digest detailed information to determine trends and tendencies

- In-depth knowledge of their industry, including competitors and adversaries

- Ability to communicate effectively at an executive level

- Ability to be agile and react to changes in the business environment

- Organizational and leadership skills

In addition to these general skills, risk managers may also need to have specific skills and experience depending on the industry in which they work.

For example, a risk manager in the financial services industry may need to have experience with financial risk management, such as credit risk, market risk, and operational risk.

Here are some examples of relevant experience for a risk manager role:

- Risk analyst

- Insurance broker

- Internal auditor

- Compliance officer

- Financial analyst

- Business analyst

What do risk managers do?

In addition to understanding the organization’s risk, a risk manager defines the company’s risk appetite. This is done by developing strategies to minimize, eliminate, or transfer the risk.

Some risks are minimal, either because the consequences are small or the probability of the event is low. Those risks may just be assumed by the company, or in other words, they just take the risk. Other risks, however, must be eliminated or transferred in the form of insurance.

Threats and risk factors are quantified and communicated by the use of a risk assessment. A risk assessment is a tool used by risk management professionals to examine known risk factors and benchmark them against known probable consequences.

A risk assessment is used to formulate appropriate ways to eliminate or minimize risk. Considering threats from weather and natural disasters to civil unrest and potential competitor mergers and acquisitions, risk managers must be ready to counsel company leadership on a possible course of action.

In well-staffed organizations, the risk manager may be able to rely on input from peers and subordinates, such as:

- Cyber risk specialists

- Security director

- Chief information officer

- Threat intelligence specialists

- Chief resilience officer (commonly found in municipalities)

The risk manager’s job is to evaluate input from all available sources and then quantify risks for senior decision-makers in the company. They often assist senior management in defining business strategies that avoid or mitigate risks.

Risk manager job description

The role of the risk manager is to develop and communicate risk policies for an organization. They develop risk models for each risk category; market, credit, operational, and reputation. They apply the risk formula (Risk = Threat x Probability x Criticality) to determine appropriate risk acceptance, reduction, elimination, or transference strategies.

Typical duties include:

- Designing and executing a risk management process

- Perform or oversee risk assessments to cover all business risks

- Define the organization’s risk appetite

- Prepare and balance risk management and insurance budgets

- Define risk reporting procedures

- Communicate risk policies to stakeholders

- Create or approve business continuity plans

- Oversee company health and safety plans

- Conduct or oversee compliance audits

- Review significant contracts and proposals

A recent job description posted on a popular employment website reads as follows.

“[The company] seeks an experienced Risk Manager to join their team in New York.

- In this highly visible role, the successful candidate will be responsible for monitoring and managing equity portfolio risk, scenario analysis, multi-factor modeling, and tail-risk analysis.

- Regularly interact with portfolio managers and senior management on all equity risk-related matters.

- Advanced degree in a quantitative discipline with a minimum of 5+ years of risk and/or quantitative analysis experience gained as a leading asset manager.

- Extensive factor modeling experience is a key requirement.

- Deep knowledge of fundamental equities trading strategies is key.

- Programming ability in Python or R is strongly preferred.

- Clear, deliberate, and thoughtful communication skills are critical as regular interaction with the desk and senior management is an integral part of this role.”

A risk manager job description for another industry would read quite differently. Some interesting similarities are likely to be consistent, however. Note that “deep knowledge and fundamentals” of the hiring firm’s business are expected.

This requirement should be expected regardless of the industry. Also, note that communication skills and the ability to interact with senior management are required.

Certificates or Special Training Required for Risk Managers

Since an intimate knowledge of specific business nuances is desirable, the training and educational requirements for the role of risk manager will vary widely depending on industry and organizational type which include:

- A bachelor’s degree in business administration or management should be considered a minimum requirement

- An MBA is preferred (check out this page for information)

- A law degree

- A degree in finance or economics

- Several years of previous experience in risk management

Some key certifications and special training programs:

- Certified Risk Manager (CRM) offered by the National Alliance for Insurance Education & Research, this program focuses on analyzing, controlling, financing, and practicing risk management.

- Certified in Risk Management Assurance (CRMA) this certification from The Institute of Internal Auditors (IIA) emphasizes risk management assurance, governance processes, and assurance/control assurance.

- Professional Risk Manager (PRM) is offered by the Professional Risk Managers’ International Association (PRMIA), this designation is especially valuable for those in the financial sector.

- Financial Risk Manager (FRM) is a globally recognized certification offered by the Global Association of Risk Professionals (GARP). It’s particularly relevant for risk professionals in banks, investment banks, and corporate finance.

- Associate in Risk Management (ARM) offered by The Institutes, provides foundational knowledge and focuses on risk assessment and control.

- Certified Information Systems Auditor (CISA) while it’s more oriented toward IT audit, it’s valuable for risk managers dealing with IT risks. Offered by the Information Systems Audit and Control Association (ISACA).

- ISO 31000 Risk Management Certification A standard provided by the International Organization for Standardization (ISO) which offers principles and guidelines for creating a risk management framework and process.

- Chartered Enterprise Risk Analyst (CERA) offered by the Society of Actuaries, this credential merges actuarial and enterprise risk management knowledge.

- TFA™ – Chartered Financial Consultant (ChFC) focused on diverse financial disciplines, and can be useful for risk managers, especially in sectors like insurance and banking.

Outlook for risk managers

The overall outlook for the risk manager is excellent. Risk management as a profession is just coming into itself. For many years many organizations addressed risk in a segmented way where each office, branch, division, or plant manager was responsible for managing their local risks.

Only over the last two decades have companies embraced the idea that an executive with company-wide authority and responsibility is needed.

Recruiter.com said, “The overall job outlook for Risk Management Specialist careers has been relatively unchanged since 2019. Vacancies for this career have slightly decreased by -0.38 percent nationwide in that time, with an average decline of -0.38 percent per year. Demand for Risk Management Specialists is expected to go up, with an expected 54,350 new jobs filled by 2029. This represents an annual increase of 1.31 percent over the next few years..”

How much do risk managers make?

Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, and the number of years you have spent in your profession.

According to Salary.com, the average risk manager salary in the US is $124,513 as of 2024, but the range typically falls between $111,245 and $139,544. While Payscale.com lists the average risk manager salary at $94,658, the location will invariably make a significant difference in overall compensation.

Frequently asked questions

A risk manager is responsible for identifying, assessing, and mitigating risks that may affect an organization’s operations, reputation, and financial performance. They work to minimize the negative impact of potential risks by developing and implementing risk management strategies and plans.

Identify all scenarios that could go wrong and the consequences or impact they would have on the business and the criticality.

A bachelor’s degree in business administration or management should be considered a minimum requirement while training requirements and certifications for risk managers vary on the industry and organization.

The outlook for risk managers is generally positive, as companies across various industries continue to recognize the importance of identifying, assessing, and mitigating risks in their operations. As such, the demand for risk managers is expected to grow in the coming years.

Ability to analyze data and information objectively to develop a big-picture view of risk, digesting detailed information to determine trends and tendencies, and being able to react to changes quickly.